In this section

- Directors’ Report

- Corporate Governance Report

- Directors’ Remuneration Report

- Corporate Social Responsibility

Governance

Directors’ Remuneration Report

Letter to Shareholders

Dear Shareholder,

I am pleased to present to you, on behalf of the Board and the Remuneration Committee, the Remuneration Committee’s report on our Board Directors’ remuneration for the financial year 2011.

We believe it is important to continue to foster shareholder confidence in the integrity of our remuneration decisions and, therefore, in 2011 we remained in dialogue with major shareholders regarding the remuneration packages offered to Executive Directors, seeking as in previous years to maintain executive remuneration which:

- is in the best interests of the Company;

- takes account of pay in the rest of the business;

- is reasonable and in line with shareholder guidelines; and

- will be applied consistently for the future.

The Remuneration Committee has continued to work with and been advised by Mercer Ltd. on Executive Remuneration related matters and consulted them for advice on market trends, incentive design questions and other relevant matters.

The terms of reference of the Remuneration Committee (the “Committee”) determine the policy for the remuneration of Lamprell’s Executive Directors, the Company Secretary and such other members of senior management as it is designated to consider. There have been some minor amendments to the terms of reference since the last Remuneration Report and the full terms of reference of the Committee are available on the Company’s website – www.lamprell.com.

Members of the Remuneration Committee in 2011 have been Brian Fredrick, Colin Goodall and Richard Raynaut. Members have attended all Remuneration Committee meetings. In addition, the Company Chairman, Jonathan Silver and the Chief Executive Officer, Nigel McCue attended meetings by invitation but were at no stage present when elements of their own remuneration were discussed.

The following pages provide a more detailed description of current Lamprell Executive Remuneration including changes that have been agreed upon during 2011.

Brian Fredrick

Chairman of the Remuneration Committee

Executive remuneration policy and pay principles

Our remuneration policy for Executive Directors gives consideration to remuneration policy and levels for the wider employee population and is designed to enable the recruitment, retention and motivation of Executive Directors and senior managers of the highest calibre. Our remuneration policy aims to drive business performance and maximise shareholder value through offering remuneration packages to our senior management that are appropriately balanced between base salary and variable compensation and taking into account policy and practice in the UAE.

Our key remuneration principles are:

- base salaries should be competitive and bonuses should reflect both collective financial performance and personal performance. Personal performance will be determined based on stretching, quantitative and qualitative targets set individually at the beginning of each year;

- the individual performance targets for the Executive Directors are recommended by the Company Chairman and approved by the Remuneration Committee. Individual performance targets for the Vice Presidents are recommended by the Chief Executive Officer;

- maintaining the highest possible health and safety standards is of paramount importance to the Company and its business and is the collective responsibility of all Executive Directors, Vice Presidents and Employees. Any fatality that takes place in a facility operated by the Company or any of its subsidiaries will be taken into account when considering whether to pay the whole or part of the personal performance bonus; and

- performance shares are awarded in order to align the interests of senior staff and shareholders and to encourage the recipients to remain with the Company.

The Remuneration Committee met six times during this financial year. Items covered in the meetings included:

- investor consultation;

- variable pay;

- consideration of the ABI Guidelines;

- review of PSP awards; and

- review and agreement of financial targets for the annual bonus plan.

Main elements of remuneration

Total remuneration, in line with our remuneration policy, is made up of a balance of fixed and variable compensation. The current executive remuneration packages for Lamprell Executives and Senior Managers are structured as follows:

| Component | Objective | Performance period | Performance measure | Delivery vehicle |

|---|---|---|---|---|

| Base salary | Reflect competitive market, level of responsibility and individual contribution to fulfilling role requirements | n/a | Normally reviewed annually taking into account individual performance, competitive positioning and roles and responsibilities | Monthly cash payment |

| Allowances | Provide additional payments in line with local market practice | n/a | n/a | Monthly cash payment |

| Annual bonus plan | Focus and motivate achievement of annual targets | One year | Pre-defined performance targets split between financial and individual objectives | Annual cash payment |

| Performance share plan | Reward executives for achievement of longer-term earnings, value creation and share price growth. Aligns executives’ and shareholder interests | Three years | Growth in Earnings Per Share (EPS) over the three-year performance period | Full value shares |

| Retirement benefits | Offer executives a retirement benefit in line with minimum legal requirement | n/a | n/a | Lump sum cash payment following retirement based on length of service and final salary |

Each element is described in further detail in separate sections below. The Committee considers all elements of the pay structure to be important in supporting the Company’s remuneration policy.

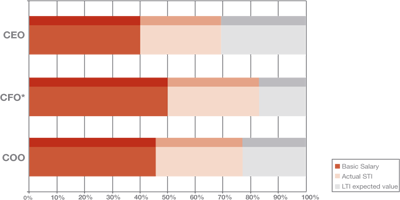

Pay mix

In 2011, the remuneration mix for Lamprell Executive Directors, including long term and short-term incentives (“LTI” and “STI” respectively) was as follows:

* Scott Doak retired from the Board of Directors with effect from 30 October 2011.

Elements of remuneration

Base salary

Provide a market competitive base salary that reflects the role, skills, experience and contribution of the individual

In 2011, following the 2010 review of base salaries, the Committee decided to continue to position base salaries to recognise the following:

- Lamprell positions pay at levels to reflect the size and performance of the Company;

- the results of the benchmarking exercises undertaken by Mercer in both 2009 and 2010 had indicated anomalies between the base salaries and bonus amounts paid by the Company, and that of its comparator group, with base salaries significantly lower and variable pay through bonus significantly higher than the comparator group; and

- the Committee considered that too high a level of variable pay (i.e. pay which is “at risk”) could lead to the loss of key Executive Directors in difficult economic circumstances when continuity is most important.

The table below shows the base salaries of each current Executive Director effective as at 1 January 2011, and those that will apply from 1 January 2012.

| Name | Position | Base salary from 1 January 2011 |

Base salary from 1 January 2012 |

% increase |

|---|---|---|---|---|

| Nigel McCue | Chief Executive Officer | $801,375 | $841,444 | 5 |

| Jonathan Cooper* | Chief Financial Officer | $400,000 | $420,000 | 5 |

| Scott Doak** | Chief Financial Officer | $472,153 | n/a | n/a |

| Christopher Hand*** | Chief Operating Officer | $400,000 | $440,000 | 10 |

*Jonathan Cooper was appointed to the Board of Directors with effect from 30 October 2011.

**Scott Doak retired from the Board of Directors with effect from 30 October 2011.

***Christopher Hand was appointed to the Board of Directors with effect from 26January 2011.

In line with market practice in the U.A.E., the Executive Directors also receive other benefits including car allowances, housing allowances, utilities for housing, school fees for children up to the age of 18 years old, annual airline tickets, medical and life insurance, petrol costs and club memberships. The cash value of the benefits received by each Executive Director in 2011 is shown in the summary annual remuneration table.

Annual bonus

Focus and motivate Executive Directors to achieve annual performance targets

Performance measures

The Committee establishes performance measures and targets under the annual bonus plan for Executive Directors. Performance measures used are designed to reward the delivery of key priorities for the year. In the 2011 plan year, payout of two thirds of the bonus was based on financial targets, with the remaining one third following dialogue with major shareholders, dependent on the achievement of personal objectives, representing a change from the previous 60/40 respective ratio. In setting financial targets, the Board focuses on key annual strategic objectives. For 2011, financial metrics were based upon achievement of a net profit target, and the Committee determined that in order to achieve the maximum payout in respect of the portion of the bonus dependent upon the achievement of financial targets, such targets would be required to be exceeded by at least 20%.

In setting the personal objectives for the Executive Directors, the Board focuses on the Company’s strategic plan and taking into account the Company’s corporate values. Personal objectives cover a variety of financial and operational targets that contribute to the achievement of goals in the strategic plan and in 2011 included, amongst other matters, enhancing HSES procedures and developing the senior staff team. The Committee evaluates executive performance against the individual bonus criteria in determining the level of bonus award to be made.

Bonus opportunities

In reviewing total remuneration arrangements, the Committee decided in 2009 to reduce the bonus opportunity for Executive Directors from a maximum of 200% of base salary to a maximum of 100% of base salary.

For 2011, there was no change to the annual maximum bonus opportunity for Executive Directors with bonus opportunities capped at a maximum of 100% of base salary. The annual bonus plan is discretionary and the Committee reserves the right to make adjustments to payouts if it believes exceptional circumstances warrant doing so. In particular, the Committee has an overriding discretion to consider, if deemed necessary, performance on environmental, social and governance issues when determining the annual bonus payments for the Executive Directors. In accordance with the applicable policy, bonuses for 2011 were reduced as a result of a yard fatality which took place in December 2011.

2011 performance

In view of the Company’s financial performance during 2011 the Committee has determined that the following bonuses will be paid:

| Name | Maximum bonus as a percentage of salary |

Bonus paid as a percentage of salary |

|

|---|---|---|---|

| Nigel McCue | 100% | 72.3% | |

| Scott Doak | 100% | 64.8% | |

| Jonathan Cooper | 100% | 67.1% | * |

| Christopher Hand | 100% | 67.1% | |

* pro rata from date of appointment.

Long-term incentives

Reward and motivate executives for achievement of longer-term value creation and align executive and shareholder interests

Long term incentives are provided to eligible employees under the provisions of three different share-based plans:

The Lamprell plc Executive Share Option Plan, the Lamprell plc Retention Share Plan and the Lamprell plc 2008 Performance Share Plan. The 2008 Performance Share Plan is intended to be the Company’s primary long term incentive vehicle for Executive Directors and senior management.

Executive Directors will not receive regular grants of options under the Executive Share Option Plan or receive regular awards under the Retention Share Plan. Awards under these two plans will only be used in exceptional circumstances. The Committee regularly reviews both the overall suitability of the Company’s share-based remuneration, the level of awards made under the plan operated and the performance conditions attached to those awards. Any value earned under the Company’s long term incentive plans is not pensionable.

The Lamprell plc 2008 Performance Share Plan (“PSP”)

In 2008, the PSP was agreed to be the primary long term incentive vehicle for Executive Directors. Executive Directors and other key individuals may participate in this plan that offers performance contingent awards of Lamprell shares on an annual basis. The awards will take the form of a promise to deliver free shares, but may be structured in an economically equivalent form subject to an assessment of local tax and regulatory issues. Annual awards are capped at 100% of base salary (150% of base salary in exceptional circumstances).

Performance shares will normally vest on the third anniversary of the date of grant of the award, subject to any applicable performance conditions having been satisfied. In addition, the Committee will have an overriding discretion, in exceptional circumstances (relating to either the Company or a particular participant) to reduce the number of shares that vest (or to provide that no shares vest).

PSP performance measures

The Committee believes that the performance conditions for vesting of PSP awards should strike a balance between achieving alignment with shareholder returns and reward for delivery of strong underlying performance.

The Committee has determined that awards made in 2011 will vest subject to achieving predefined Earnings Per Share (“EPS”) growth over a three-year period. The Committee considers EPS to be one of the key measures of the Company’s success, particularly because it incentivises strong earnings growth over a sustained period which is in line with the generation of future shareholder value.

For the PSP awards, EPS growth is calculated using the point-to-point method. This method compares the adjusted EPS in the Company’s accounts for the financial year ended prior to the date of grant with the adjusted EPS for the financial year ending three years later and calculates the total growth over the three-year period.

The EPS targets for awards made in 2011 and their associated vesting levels are illustrated in the table below (straight-line vesting applies between the hurdles). The EPS growth hurdles have been set taking into account the long term strategic plans of the Company but also the cyclical nature of the business in which Company operates.

| EPS growth over three-year period | Percentage

of award vesting |

|---|---|

| Less than 15% | 0% |

| 15% | 25% |

| 45% or more | 100% |

The Lamprell plc Executive Share Option Plan

The plan provides for options over Lamprell shares to be granted at market value to eligible employees. The options will normally vest after three years and be exercisable up to the tenth anniversary of the date of grant. No awards were made to Executive Directors under this plan in 2011.

The Lamprell plc Retention Share Plan

The plan provides for the conditional allocation of shares to eligible employees selected by the Board. Awards will normally vest and the shares be released with any accumulated dividends, if determined by the Board, two years after the date of grant. No awards were made to Executive Directors under this plan in 2011.

Retirement benefits

Provide retirement benefits in line with local market practice

Under employment law in the United Arab Emirates, the Executive Directors participate in a terminal gratuity scheme operated by the Company as a pension equivalent. This is operated as a cash payment based on the length of service and final salary of the Executive Director and the value of these cash provisions is c. 8% of base salary per annum.

Under the terms of the local UAE labour law the terminal gratuity accrues benefit to an employee as follows:

- 21 days per annum for the first five years of employment

- 30 days per annum for the remainder of their employment

The benefit accrues for incomplete years on a pro rata basis, is calculated using the current base salary and has a maximum benefit amounting to two years of the annual base salary.

Directors’ contracts

The policy set out below provides the framework for contracts for the Executive Directors. It is the Company’s policy that Executive Directors should have contracts with a rolling term. Maximum notice period is one year.

| Aspect of contract | Policy |

|---|---|

| Notice period (both parties) | Twelve calendar months |

| Termination payment | Up to one times annual basic salary, plus benefits but excluding bonus. The Company may elect to pay sums in lieu of notice in three separate tranches: 50% within seven working days of the termination date; 25% three months after the termination date; and 25% six months after the termination date |

| Vesting of long term incentive scheme awards | In line with the rules of the relevant equity incentive scheme – generally pro-rated for time and performance for good leavers |

| Pension | Based on existing arrangements and terms of the UAE Labour Law with respect to terminal gratuity |

The general policy on termination is that the Company does not make payments beyond its contractual obligations, i.e. no ex-gratia payments are made.

The Committee will seek to ensure that there have been no unjustified payments for failure, and as such none of the Executive Directors’ contracts provides for liquidated damages, longer periods of notice on a change of control of the Company, or additional compensation on an Executive Director’s cessation of employment.

The table below sets out the details of the Executive Directors’ service contracts:

| Director | Date of contract | Effective date |

|---|---|---|

| Nigel McCue | 16 May 2008 | 16 May 2008 |

| Scott Doak | 10 December 2006 | 1 March 2007 |

| Chris Hand | 26 January 2011 | 26 January 2011 |

| Jonathan Cooper | 19 April 2011 | 30 October 2011 |

Outside appointments for Executive Directors

Outside appointments of Lamprell Directors must be approved by the Board. It is the Company’s policy that remuneration earned from such appointments may be kept by the individual Executive Director. The external appointments of the Directors are noted below.

During 2011 Nigel McCue received £91,000 and Scott Doak received £11,025 in respect of these appointments.

| Director | Current Directorships |

|---|---|

| Nigel McCue | Dragon Oil Plc |

| Dragon Oil (Holdings) Limited | |

| Dragon Oil Limited | |

| Dragon Oil (Turkmenistan) Limited | |

| Dragon Resources (Holdings) Limited | |

| D&M Drilling Limited | |

| Frontier Holdings Limited | |

| Frontier Acquisition Company Limited | |

| Jura Energy Corporation | |

| Mavignon Shipping Limited | |

| Nemmoco Petroleum Limited | |

| Scott Doak | Caledonian Developments (Dubai) Limited |

| Caledonian Management (Dubai) Limited | |

| Caledonian Investments (Gulf) Limited |

Non-Executive Directors’ fees and contracts

The Company aims to provide Non-Executive Directors with fees that are competitive with other companies of a similar size and complexity. The Company reviewed the Non-Executive fee structure during 2011, such fees having last been reviewed in 2008, and determined to operate a fee structure with basic fees and additional fees for chairing a committee of the Board, and the fees were increased in order to maintain a competitive market position. The table below sets out the annual fees payable in respect of different roles and responsibilities:

| Fee Category | £ |

|---|---|

| Non-Executive Chairman | 164,000 |

| Senior Independent Director | 82,500 |

| Basic Member Fee | 42,225 |

| Committee Chair Fee (Excluding Nominations Committee) | 7,000 |

Non-Executive Directors are not eligible to participate in any of the Company’s incentive schemes.

The Non-Executive Directors do not have service contracts, but instead have specific letters of appointment which are available upon request and which include amongst other matters, an indication of the time commitment expected from each Non-Executive Director. Non-Executive Directors are appointed for an initial term of three years, terminable by either the Company or the Non-Executive Director at will. In normal circumstances, and subject to performance and re-election at the Annual General Meeting, the Non-Executive Directors can be asked to serve additional three-year terms. Upon termination or resignation, Non-Executive Directors are not entitled to compensation and no fee is payable in respect of the unexpired portion of the term of appointment.

The following table shows the date of the letter of appointment for each Non-Executive Director:

| Non-Executive Director | Date of letter of appointment |

|---|---|

| Jonathan Silver | 24 August 2007 |

| Colin Goodall | 14 September 2008 |

| Richard Raynaut | 7 July 2006 |

| Brian Fredrick | 14 September 2008 |

Audited information

Annual remuneration

The table below summarises Executive Directors’ remuneration for 2011 and the prior year for comparison. No payments for loss of office were made during the year to 31 December 2011.

| Base salary/ fees | Allowances and other benefits | Annual bonus | Total emoluments 2011 | Total emoluments 2010 | |

|---|---|---|---|---|---|

| Executive Directors | |||||

| Nigel McCue | $801,373 | $194,590 | $579,661 | $1,575,624 | $1,721,644 |

| Scott Doak* | $393,461 | $180,447 | $255,094 | $829,002 | $1,124,315 |

| Jonathan Cooper** | $68,402 | $24,154 | $44,743 | $137,299 | n/a |

| Christopher Hand*** | $368,548 | $259,129 | $247,347 | $875,024 | n/a |

| Total | $1,631,784 | $658,320 | $1,126,845 | $3,416,949 | $2,845,959 |

*retired 30 October 2011.

**appointed 30 October 2011.

***appointed 26 January 2011.

| Non-Executive Directors | |||||

| Jonathan Silver | $215,007 | Nil | Nil | $215,007 | $155,969 |

| Colin Goodall | $128,083 | Nil | Nil | $128,083 | $118,608 |

| Richard Raynaut | $76,438 | Nil | Nil | $76,438 | $70,894 |

| Brian Fredrick | $76,445 | Nil | Nil | $76,445 | $70,143 |

| Total | $495,973 | Nil | Nil | $495,973 | $485,613 |

Pension equivalents

The table below summarises the Executive Directors’ pension equivalent contributions for the current year, and the prior year for comparison.

| Executive Director | Total 2011 | Total 2010 |

|---|---|---|

| Nigel McCue | $65,254 | $102,761 |

| Scott Doak | $43,080 | $59,119 |

| Jonathan Cooper | $3,963 | n/a |

| Christopher Hand | $142,230 | n/a |

| Total | $254,527 | $161,880 |

In accordance with the provisions of IAS 19, management has carried out an exercise to assess the present value of its obligations at 31 December 2011 and 2010, using the projected unit credit method, in respect of employees’ end of service benefits payable under the UAE Labour Law. Under this method, an assessment has been made of an employee’s expected service life with the Group and the expected basic salary at the date of leaving the service. Management has assumed average increment/promotion costs of 5% (2010: 5%). The expected liability at the date of leaving the service has been discounted to its net present value using a discount rate of 4.25% (2010: 5.25%).

Directors’ interests

The following interests of the Directors of the Company are shown in according with the listing rules.

Where applicable, all interests in Lamprell shares have been adjusted by a factor of 1.1 as a result of the rights issue conducted by the Company in 2011.

| At 23 March 2012 | At 31 December 2011 | At 1 January 2011 | |

|---|---|---|---|

| Executive Directors | |||

| Nigel McCue | 335,999 | 335,999 | 188,461 |

| Scott Doak | n/a | n/a | 130,725 |

| Chris Hand | 378,061 | 378,061 | n/a |

| Jonathan Cooper | – | – | – |

| Non-Executive Directors | |||

| Jonathan Silver | 16,474 | 16,474 | 12,673 |

| Colin Goodall | 7,800 | 7,800 | 6,000 |

| Richard Raynaut | – | – | – |

| Brian Fredrick | – | – | – |

The table above does not include unvested interests held under the Company’s equity-based incentive schemes. These interests are set out separately below.

Share awards

On 20 May 2008 Nigel McCue and Scott Doak were granted conditional rights to receive shares at no cost. The earliest dates that the shares could vest under the conditional rights were 20 May 2011 and 10 January 2010 respectively. Receipt of the shares was conditional upon them remaining in employment with the Company until that date.

The following table sets out the interests of Nigel McCue and Scott Doak in relation to their awards:

| Executive Director | At 1 January 2011 | Granted in year |

Share price at grant |

Date of vesting | Vested | At 31 December 2011 |

|---|---|---|---|---|---|---|

| Nigel McCue | 70,000 | Nil | £5.25 | 20.05.2011 | 70,000 | Nil |

| Scott Doak | 22,275 | Nil | £4.36 | 10.01.2010 | 22,275 | Nil |

The share award to Scott Doak vested on 10 January 2010. On vesting an amount of £2,688 was paid which is equal to the aggregate amount of dividends that would have been paid on the shares to which he was entitled between the grant date and vesting date.

The share award to Nigel McCue vested on 20 May 2011. On vesting an amount of $18,655 was paid which is equal to the aggregate amount of dividends that would have been paid on the shares to which he was entitled between the grant date and vesting date.

Share option awards

On 31 March 2009 Nigel McCue and Scott Doak were granted options under the Executive Share Option Plan (“ESOP”). The earliest date that they will be entitled to receive the shares under the conditional rights is 31 March 2012. Receipt of the shares is conditional upon them remaining in employment with the Company until that date. In addition, Scott Doak was also granted an option under the ESOP on 16 May 2007.

The following table sets out the interests of Nigel McCue and Scott Doak in relation to their awards:

| Executive Director | At 1.1.2011 | Granted in year |

Exercise price at grant |

Date of vesting | Vested | Exercised in 2011 | At 31.12.2011 |

|---|---|---|---|---|---|---|---|

| Nigel McCue | 302,524 | Nil | £0.52 | 31.03.2012 | Nil | Nil | 302,524 |

| Scott Doak | 302,524 | Nil | £0.52 | 31.03.2012 | Nil | Nil | 302,524 |

| Scott Doak | 19,585 | Nil | £3.22 | 16.05.2010 | 19,585 | 19,585 | Nil |

On vesting, the options become exercisable and, subject to the rules of the Plan, will remain exercisable until 31 March 2019 (being the 10th anniversary of the grant date) for shares granted on 31 March 2009 and exercisable until 16 May 2017 (being the 10th anniversary of the grant date) for shares granted on 16 May 2007. To the extent not exercised by those dates, the grants will lapse.

Performance share plan awards

For the year ended 31 December 2011 Nigel McCue, Christopher Hand and Jonathan Cooper were granted share awards under the PSP. The earliest date that they will be entitled to receive the shares under the conditional rights is 2 September 2014 for Nigel McCue, and Christopher Hand and 8 December 2014 for Jonathan Cooper. Receipt of the shares is conditional upon satisfaction of the performance conditions related to the PSP.

The following table sets out the interests of Nigel McCue, Scott Doak, Christopher Hand and Jonathan Cooper in relation to their awards:

| Executive Director | At 1.1.2011 | Awarded for 2011 |

Date of vesting | Vested | Lapsed in 2011 | At 31.12.2011 |

|---|---|---|---|---|---|---|

| Nigel McCue | 209,249 | – | 15.04.2013 | Nil | Nil | 209,249 |

| Nigel McCue | – | 159,299 | 02.09.2014 | Nil | Nil | 159,299 |

| Scott Doak | 106,888 | – | 15.04.2013 | Nil | Nil | 106,888 |

| Christopher Hand | 62,548 | – | 15.04.2013 | Nil | Nil | 62,548 |

| Christopher Hand | – | 51,684 | 02.09.2014 | Nil | Nil | 51,684 |

| Jonathan Cooper | – | 38,512 | 08.12.2014 | Nil | Nil | 38,512 |

Awards will normally vest on the third anniversary of the date of grant of the award, subject to any applicable performance conditions having been satisfied. If the Company achieves outstanding earnings per share performance over the performance period then the full award will vest. If threshold levels of performance are achieved then 25% of the award will vest.

Share price information

On 31 December 2011, the closing price of a Lamprell plc ordinary share was 268.7 pence. The highest and lowest price of an ordinary share during 2011 was 400 pence and 214.85 pence respectively, based on the London Stock Exchange Daily Official List.

TSR performance graph

The graph below sets out the performance of Lamprell’s Total Shareholder Return comprising share price growth plus reinvested dividends relative to the Total Return of the FTSE 250 Index of which the Company is a constituent. The graph covers time from 31 December 2006 to 31 December 2011. The graphs are not an indication of the likely vesting of awards granted under any of the Company’s incentive plans.

Lamprell – TSR since AIM listing

Approval

This report has been approved by the Committee, on behalf of the Board, on the date shown below and signed on the Board’s behalf by:

Brian Fredrick

Chairman of the Remuneration Committee

23 March 2012

Explore

- Highlights 2011

- Lamprell at a Glance

- Performance

- Chairman’s statement

- Chief Executive’s Review

- Review of operations

- Risk assessment

- Financial review

- Corporate social responsibility

- Board of Directors

- Corporate governance

- Financial statements

- Download centre

- Shareholder information

Download a PDF of the 2011 Annual Report